Apply on the net in minutes.‡ If you link your business accounts towards your Business Line of Credit rating software, your money info is reviewed in authentic time for an productive final decision.

To secure the best business loan fitted to you, ensure the repayment conditions align along with your economic organizing. What type of business loans are available?

If you're able to pinpoint your requirements specifically on new machinery or facilities, nonetheless, the SBA 504 loan is your very best bet. It’s just like the conventional 7(A), with loans of around $twenty million and prolonged repayment phrases, however it’s created especially for huge, stationary shelling out. Check into the 504 In case your business is wanting new land, new amenities, or expanded functions.

Should be capable of exhibit the necessity for a loan and demonstrate the business reason for which you’ll use the funds.

There are actually a number of options for funding your business. Below are some of the most common varieties of business loans:

Semrush is actually a dependable and detailed Device which offers insights about on the net visibility and general performance. The BestMoney Complete Score will encompass the manufacturer's name from Semrush. The manufacturer popularity is based on Semrush's analysis of clickstream data, which includes user actions, research styles, and engagement, to properly measure Every manufacturer's prominence, reliability, and trustworthiness.

If the software is permitted, SBA 504 loans typically just take one to two months to shut. But closing can take for a longer period for greater and more complicated buys.

BestMoney actions person engagement determined by the volume of clicks Every shown manufacturer explore here received before seven times. The number of clicks to each model are going to be measured towards other models stated in exactly the same query.

Look into our FAQs for more information regarding how a small business line of credit with American Convey® functions.

We earn a commission from brand names mentioned on This great site. This influences the get and method in which these listings are introduced.

We goal to offer precious articles and helpful comparison features to our people by our free of charge online source. It is important to note that we receive advertising payment from organizations showcased on our website, which influences the positioning and purchase through which manufacturers (and/or their solutions) are shown, and also the assigned rating. Remember to be aware that the inclusion of enterprise listings on this web site would not imply endorsement.

CDCs are uniquely experienced to understand 504 loan program rules and can assist you navigate the lender channels to create your project funding.

Max desire rates are pegged into a foundation price, using the primary rate, LIBOR price, or an optional peg charge—but normally the primary amount posted by the Wall Street Journal. Generally, the prime charge is 300 points over the federal money charge.

What’s more, The federal government caps the sba loan rate, which means you’ll by no means must shell out the substantial fascination costs and modest business loan APR typically affiliated with other sorts of business loans.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Jaleel White Then & Now!

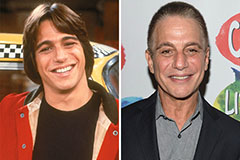

Jaleel White Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now!